The taxation of super death benefits

Wondering if your beneficiaries will pay tax on your superannuation death benefits? The answer is it depends on a number of important factors.

Most people will have heard of Benjamin Franklin’s quote “in this world, nothing is certain except death and taxes”. He raises a valid point as the tax office will be ready to take their share of your death benefits when the time comes.

With that in mind, it is important to understand the tax rules that govern superannuation death benefits so you can ensure your benefits are distributed to your beneficiaries in the most tax-effective manner possible.

This article briefly summarises the three key factors that will determine whether your superannuation death benefits will be taxed when distributed to your beneficiaries.

1. Will a tax dependant receive the benefit?

The concept of super and tax law dependants was covered in detail in November’s Newsletter. However, to recap, a tax dependant will not pay any tax on your super death benefits.

A tax dependant includes the following people:

■ A current spouse, including defacto and former spouse

■ Children under 18

■A person who is financially dependent or in an interdependency relationship with the deceased.

2. The underlying components of your benefit

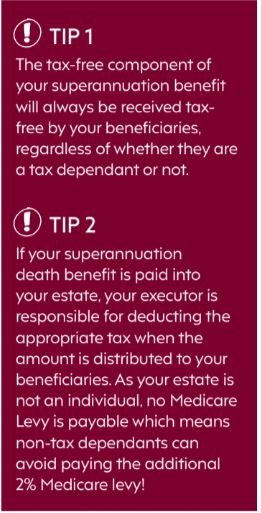

Your current superannuation benefit may comprise of a taxable component and a tax-free component. As such, when you pass away, any death benefit payment made to your beneficiary(s) will reflect the proportions of the tax components of your member balance.

The taxable component of your superannuation benefit generally includes concessional contributions, such as superannuation guarantee and salary sacrifice contributions, and earnings made on your account balance.

However the taxable component of your superannuation benefit may also consist of an untaxed element if:

■ Your benefit is paid from an untaxed fund (ie, your fund does not pay 15% tax on contributions or earnings – this is common in public sector funds and constitutionally protected funds, however most Australians are in taxed superannuation funds), or

■ Your death benefit contains insurance proceeds and the fund has claimed a tax deduction for life insurance premiums.

3. How will the death benefit be paid – lump sum or income stream?

Lump sum death benefits

Lump sum superannuation death benefits paid to tax dependants directly or via your personal legal representative are not taxed.

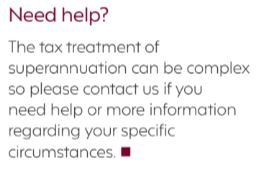

However death benefits paid to non-tax dependants (ie, a financially independent adult child) are subject to tax on any taxable component of the lumpsum superannuation benefit, which may include both a taxed and/or untaxed element.

Table 1 below summarises how the taxable component of a superannuation death benefit is taxed when it is paid as a lump sum in the event of a person’s death.

Death benefit income streams

Table 2 below summarises the tax payable on tax components based on the age of the beneficiary (at the date of payment) and the age of deceased (at the date of death).As can be seen, the tax treatment depends on the age you pass away, the age of your beneficiary, as well as the underlying tax components of the income stream.